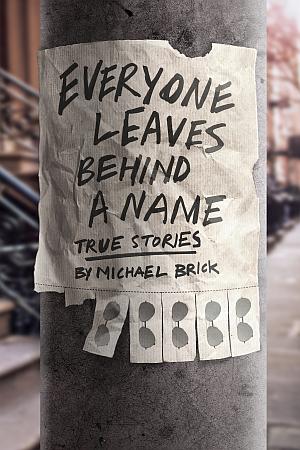

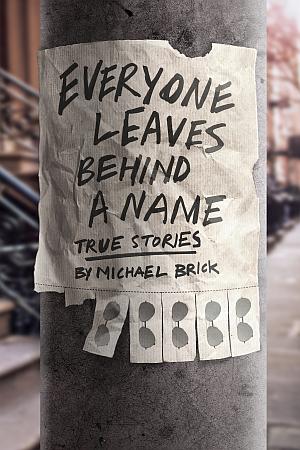

This is the third of ten stories Storyboard will post from a new collection honoring Michael Brick [see our 5 Questions on the project], each featuring an introduction by a writer who loved his work. Today’s entry is introduced by Chris Jones.

There is something joyously subversive that Michael Brick has managed to write the way he does in American newspapers—major American newspapers—for so long. He abides none of the usual standards of economy or structure or even punctuation. I can imagine one of his editors receiving his copy and thinking, “Didn’t I assign this guy a brief?” I can imagine another hollering across the newsroom, “Hey Brick, have you ever heard of THE FUCKING COMMA!” (If such a bullheaded character were named Mr. Brick in a movie, it would be a little too on the nose. Thankfully real life doesn’t much care about its audience.) But Brick the writer, like Brick the man, isn’t lawless. He follows many rules; they just happen to be his own. This story, about a family’s long fight against an oil company, written in the midst of his own titanic struggle, demonstrates so perfectly the Brick Code: Ordinary people are the most deserving of extraordinary language. His hundreds of subjects over the years have so been given a gift. By fate of newsroom assignment, they won the company of an empathetic man who feels that the people to whom we afford the least notice deserve the most of his. I don’t expect Minerva Ramirez has any notion that a stranger came into her house and took careful measure of her obsession with Tinkerbell and then wrote a story that made his readers want to run through a wall on her behalf. That doesn’t make her, or any of us, any less fortunate for however long we enjoyed Mr. Brick’s attentions. —Chris Jones

The Houston Chronicle, October 25, 2015

DATELINE: Laredo, Texas

Minerva Ramirez wears her fine hair in a floral bow, pretty like Tinkerbell. At her brother's house in South Texas, she watches slapstick comedy videos, sings along to Michael Jackson and serves her dolls tea on Tinkerbell placemats. At night, she sleeps under Tinkerbell sheets.

"She can't tell time," says her brother, Leon Ramirez Jr., "but she has Tinkerbell on her wristwatch."

At 62, Minerva has long outlived the predictions of her doctors, despite the complications of aging with Down syndrome. She hugs strangers and calls any woman with gray hair "Abuela." In the electronics aisle at Kmart, Leon videotapes her dancing to the music of display stereos.

Leon pledged to take care of his sister, and he has. But Minerva seems to know little of her brother's worries. He is fighting to save their home, as mortgage debts have eroded the family's finances.

By Leon's account, supported by the ruling of an exasperated judge, petroleum companies owe them millions of dollars for wells drilled on property inherited from their grandmother. The main defendant, ConocoPhillips of Houston, has refused to pay, filing multiple appeals including one to the state Supreme Court. A co-defendant, EOG, also of Houston, has settled its role. Both firms declined comment.

Judge Joe Lopez of 49th state district court has chastised lawyers for ConocoPhillips and other parties for making redundant attacks "under the disguise of allegedly newly discovered evidence."

Oil and gas companies have developed a reputation over the years for tenacious legal defenses. As Texas braces for a long bust in its most important industry, legal observers say energy companies will play even tougher in the courtroom to protect their financial interests. For some landowners whose royalty payment agreements have turned sour, the legal fight likely will drag on with no end in sight.

"In any case where significant money is involved, ... companies often feel an obligation to litigate so that a settlement doesn't become precedent and routine," said William Keffer, an oil and gas expert who lectures at Texas Tech University School of Law.

As the industry has consolidated into giant corporations with vast resources, energy companies have deployed increasingly sophisticated strategies in prominent environmental lawsuits, including the Exxon Valdez spill in 1989 and the BP Deepwater Horizon blowout in the Gulf of Mexico five years ago.

While big spills make big headlines, petroleum companies deal more frequently with a different area of law: contracts. Surveying 800 corporate lawyers for a report in May, the law firm Norton Rose Fulbright found that 45 percent of energy companies listed contracts as a top legal concern, compared to 34 percent for other industries.

"The structure of this industry with landowners, royalty owners, oil companies, customers and on through the midstream and downstream relies on a series of contracts among parties whose interests are not always aligned," said Bruce Bullock, director of the Maguire Energy Institute at Southern Methodist University. "The sheer number of interests results in more litigation."

***

The Ramirez family of Zapata County built a life in the brushlands of the early 20th century, running cattle on a tract of land near the border. They called it Las Piedras Ranch. There they raised three children, who gave them grandchildren. Minerva came along in 1953.

"She was my dad's favorite," said her brother, Leon Jr. "That's fine with us, because we love her, too."

Minerva and Leon grew up in Laredo, away from life on the ranch. Their grandfather died in 1966; their grandmother followed in 1988. A few years later, oil companies leased the right to drill on Las Piedras Ranch. Gas wells flourished. Millions of dollars flowed. The Ramirezes all received royalties based on mineral rights.

Minerva's father, Leon Sr., invested his share poorly, according to the family's lawyer, Alberto Alarcon. He took on hefty mortgage loans to buy old apartment buildings, hotels and truck stops.

By the time the recession arrived, the wells had run dry, Alarcon said. Debts accrued. Banks foreclosed on some properties; the IRS placed liens on others. "They're about to lose everything," Alarcon said.

Then some old documents came to light.

***

To drill for oil and gas, energy companies must first determine who owns the minerals buried underground.

Over generations, by inheritance or sale, mineral rights frequently become separated from ownership of the land. In the oil boom that ended last year, industry researchers known as landmen packed courthouses across the state, seeking to determine the proper owners to sign mineral contracts.

As petroleum companies and landowners come to terms with a price crash that has made drilling less profitable, settling the legacy of those hastily drawn contracts has fallen to the courts.

"Royalty owners will be motivated to scrutinize their royalty statements more closely, to make sure they are getting what they're owed," Keffer said, "and there will be no shortage of plaintiff's lawyers ready to confirm that that's the case."

In Texas, where the industry contributes billions of dollars to the tax base and employs hundreds of thousands of people, legal experts say, petroleum company lawyers can find themselves emboldened by sympathetic officials.

"Texas appellate court decisions have been largely favorable to oil and gas producers, not just the big ones but any of them, for 100 years," said Bruce Kramer, a lawyer who advises corporate energy companies for McGinnis Lochridge of Houston.

But every case is judged on its own merits, Kramer said, and companies have a right to decide how to represent their interests in court.

"As any ongoing enterprise would do, they're going to make a business decision on whether it's important to fight or if it's okay to settle."

***

Grandmother Leonor Ramirez, the matriarch known as Mama No-ne, had left behind a small amount of stock. It finally drew the attention of the family around 2010, Alarcon said, when the executor of her will faced her own final days.

Hired to help settle ownership of the stock, Alarcon consulted the grandmother's will. To her daughter had gone clothing, jewelry and some property in Laredo. To one son, Leon Sr., the father of Minerva and Leon Jr., had gone a car and the land at Las Piedras Ranch. Upon his death, she wrote, "the title shall vest in his children then living in equal shares."

Her other son, Rodolfo Ramirez, received a one-third portion of any remaining property. According to Alarcon, Rodolfo made his own separate arrangements with ConocoPhillips and EOG, also of Houston.

In a 1997 letter, a senior land adviser for Conoco wrote to Rodolfo suggesting a recalculation. Instead of just his own established mineral rights, Rodolfo's portion would expand to include mineral rights connected to the land belonging to Grandmother Leonor. The adviser provided a stipulation for family members to sign.

"Rapidly on the very next day," Alarcon wrote in a civil complaint, "Rodolfo reported to his conspiracy principal, Conoco, that the transgression had been accomplished, and demanded his share of the loot."

The oil companies never had a valid lease on the grandmother's land, Alarcon wrote. Enlisting Rodolfo to trick his niece and nephew, he argued, the companies held onto millions of dollars that should have gone to Minerva and Leon Jr. The judge agreed with Alarcon that this tactic amounted to a conspiracy.

Rodolfo Ramirez could not be reached for comment, and his lawyer didn't return phone calls.

In court filings, ConocoPhillips argued that changes in the state probate code invalidate Leon and Minerva Riveras' claim to ownership of the grandmother's mineral rights. Further, the company noted, business had proceeded for more than 20 years in good faith before their wing of the family sued to obtain a new and improper interpretation of the will.

"Two generations in the Ramirez family now dispute the meaning of Leonor's will," wrote lawyers for ConocoPhillips. "They have no claim."

***

Minerva's Tinkerbell sheets are tucked into a hospital bed now. Since she stopped eating a few years ago, a feeding tube delivers nutrients into her abdomen. An oxygen device supplements her breathing. Twice a week, she receives visits from a nurse and a therapist. She uses a walker to hand out candy at Halloween.

"My dad knew that Minerva would never be put in a home or an institution," said Leon Jr. "There's a real person, a real human being in Minerva …"

His voice trailed off. The promises he made to his father are getting harder to keep. Since Nov. 19, 2010, he has been fighting the oil companies and his uncle in court. After multiple rounds of appeals and judgments - all in his favor - little has been resolved.

"This case was litigated for over four years," Lopez wrote. Each time ConocoPhillips lost, the judge noted, the company tried to start over by challenging jurisdiction, turning the lawsuit into a probate proceeding and deploying other baseless tactics.

On May 11, 2015, Lopez signed an order directing ConocoPhillips to pay Minerva $3.7 million, plus attorney's fees of $1.1 million. The order was titled, "Final Judgment." ConocoPhillips has appealed.

"Maybe I would've given up years ago, but I know Minerva needs somebody to stand and fight for her," Leon Jr. said. "And we want Conoco to do the right thing."

Now he is running out of time. The IRS has posted the family home for foreclosure sale on Oct. 29.

There is something joyously subversive that Michael Brick has managed to write the way he does in American newspapers—major American newspapers—for so long. He abides none of the usual standards of economy or structure or even punctuation. I can imagine one of his editors receiving his copy and thinking, “Didn’t I assign this guy a brief?” I can imagine another hollering across the newsroom, “Hey Brick, have you ever heard of THE FUCKING COMMA!” (If such a bullheaded character were named Mr. Brick in a movie, it would be a little too on the nose. Thankfully real life doesn’t much care about its audience.) But Brick the writer, like Brick the man, isn’t lawless. He follows many rules; they just happen to be his own. This story, about a family’s long fight against an oil company, written in the midst of his own titanic struggle, demonstrates so perfectly the Brick Code: Ordinary people are the most deserving of extraordinary language. His hundreds of subjects over the years have so been given a gift. By fate of newsroom assignment, they won the company of an empathetic man who feels that the people to whom we afford the least notice deserve the most of his. I don’t expect Minerva Ramirez has any notion that a stranger came into her house and took careful measure of her obsession with Tinkerbell and then wrote a story that made his readers want to run through a wall on her behalf. That doesn’t make her, or any of us, any less fortunate for however long we enjoyed Mr. Brick’s attentions. —Chris Jones

Awaiting millions, brother fights for sister, their home

The Houston Chronicle, October 25, 2015

DATELINE: Laredo, Texas

Minerva Ramirez wears her fine hair in a floral bow, pretty like Tinkerbell. At her brother's house in South Texas, she watches slapstick comedy videos, sings along to Michael Jackson and serves her dolls tea on Tinkerbell placemats. At night, she sleeps under Tinkerbell sheets.

"She can't tell time," says her brother, Leon Ramirez Jr., "but she has Tinkerbell on her wristwatch."

At 62, Minerva has long outlived the predictions of her doctors, despite the complications of aging with Down syndrome. She hugs strangers and calls any woman with gray hair "Abuela." In the electronics aisle at Kmart, Leon videotapes her dancing to the music of display stereos.

Leon pledged to take care of his sister, and he has. But Minerva seems to know little of her brother's worries. He is fighting to save their home, as mortgage debts have eroded the family's finances.

By Leon's account, supported by the ruling of an exasperated judge, petroleum companies owe them millions of dollars for wells drilled on property inherited from their grandmother. The main defendant, ConocoPhillips of Houston, has refused to pay, filing multiple appeals including one to the state Supreme Court. A co-defendant, EOG, also of Houston, has settled its role. Both firms declined comment.

Judge Joe Lopez of 49th state district court has chastised lawyers for ConocoPhillips and other parties for making redundant attacks "under the disguise of allegedly newly discovered evidence."

Oil and gas companies have developed a reputation over the years for tenacious legal defenses. As Texas braces for a long bust in its most important industry, legal observers say energy companies will play even tougher in the courtroom to protect their financial interests. For some landowners whose royalty payment agreements have turned sour, the legal fight likely will drag on with no end in sight.

"In any case where significant money is involved, ... companies often feel an obligation to litigate so that a settlement doesn't become precedent and routine," said William Keffer, an oil and gas expert who lectures at Texas Tech University School of Law.

As the industry has consolidated into giant corporations with vast resources, energy companies have deployed increasingly sophisticated strategies in prominent environmental lawsuits, including the Exxon Valdez spill in 1989 and the BP Deepwater Horizon blowout in the Gulf of Mexico five years ago.

While big spills make big headlines, petroleum companies deal more frequently with a different area of law: contracts. Surveying 800 corporate lawyers for a report in May, the law firm Norton Rose Fulbright found that 45 percent of energy companies listed contracts as a top legal concern, compared to 34 percent for other industries.

"The structure of this industry with landowners, royalty owners, oil companies, customers and on through the midstream and downstream relies on a series of contracts among parties whose interests are not always aligned," said Bruce Bullock, director of the Maguire Energy Institute at Southern Methodist University. "The sheer number of interests results in more litigation."

***

The Ramirez family of Zapata County built a life in the brushlands of the early 20th century, running cattle on a tract of land near the border. They called it Las Piedras Ranch. There they raised three children, who gave them grandchildren. Minerva came along in 1953.

"She was my dad's favorite," said her brother, Leon Jr. "That's fine with us, because we love her, too."

Minerva and Leon grew up in Laredo, away from life on the ranch. Their grandfather died in 1966; their grandmother followed in 1988. A few years later, oil companies leased the right to drill on Las Piedras Ranch. Gas wells flourished. Millions of dollars flowed. The Ramirezes all received royalties based on mineral rights.

Minerva's father, Leon Sr., invested his share poorly, according to the family's lawyer, Alberto Alarcon. He took on hefty mortgage loans to buy old apartment buildings, hotels and truck stops.

By the time the recession arrived, the wells had run dry, Alarcon said. Debts accrued. Banks foreclosed on some properties; the IRS placed liens on others. "They're about to lose everything," Alarcon said.

Then some old documents came to light.

***

To drill for oil and gas, energy companies must first determine who owns the minerals buried underground.

Over generations, by inheritance or sale, mineral rights frequently become separated from ownership of the land. In the oil boom that ended last year, industry researchers known as landmen packed courthouses across the state, seeking to determine the proper owners to sign mineral contracts.

As petroleum companies and landowners come to terms with a price crash that has made drilling less profitable, settling the legacy of those hastily drawn contracts has fallen to the courts.

"Royalty owners will be motivated to scrutinize their royalty statements more closely, to make sure they are getting what they're owed," Keffer said, "and there will be no shortage of plaintiff's lawyers ready to confirm that that's the case."

In Texas, where the industry contributes billions of dollars to the tax base and employs hundreds of thousands of people, legal experts say, petroleum company lawyers can find themselves emboldened by sympathetic officials.

"Texas appellate court decisions have been largely favorable to oil and gas producers, not just the big ones but any of them, for 100 years," said Bruce Kramer, a lawyer who advises corporate energy companies for McGinnis Lochridge of Houston.

But every case is judged on its own merits, Kramer said, and companies have a right to decide how to represent their interests in court.

"As any ongoing enterprise would do, they're going to make a business decision on whether it's important to fight or if it's okay to settle."

***

Grandmother Leonor Ramirez, the matriarch known as Mama No-ne, had left behind a small amount of stock. It finally drew the attention of the family around 2010, Alarcon said, when the executor of her will faced her own final days.

Hired to help settle ownership of the stock, Alarcon consulted the grandmother's will. To her daughter had gone clothing, jewelry and some property in Laredo. To one son, Leon Sr., the father of Minerva and Leon Jr., had gone a car and the land at Las Piedras Ranch. Upon his death, she wrote, "the title shall vest in his children then living in equal shares."

Her other son, Rodolfo Ramirez, received a one-third portion of any remaining property. According to Alarcon, Rodolfo made his own separate arrangements with ConocoPhillips and EOG, also of Houston.

In a 1997 letter, a senior land adviser for Conoco wrote to Rodolfo suggesting a recalculation. Instead of just his own established mineral rights, Rodolfo's portion would expand to include mineral rights connected to the land belonging to Grandmother Leonor. The adviser provided a stipulation for family members to sign.

"Rapidly on the very next day," Alarcon wrote in a civil complaint, "Rodolfo reported to his conspiracy principal, Conoco, that the transgression had been accomplished, and demanded his share of the loot."

The oil companies never had a valid lease on the grandmother's land, Alarcon wrote. Enlisting Rodolfo to trick his niece and nephew, he argued, the companies held onto millions of dollars that should have gone to Minerva and Leon Jr. The judge agreed with Alarcon that this tactic amounted to a conspiracy.

Rodolfo Ramirez could not be reached for comment, and his lawyer didn't return phone calls.

In court filings, ConocoPhillips argued that changes in the state probate code invalidate Leon and Minerva Riveras' claim to ownership of the grandmother's mineral rights. Further, the company noted, business had proceeded for more than 20 years in good faith before their wing of the family sued to obtain a new and improper interpretation of the will.

"Two generations in the Ramirez family now dispute the meaning of Leonor's will," wrote lawyers for ConocoPhillips. "They have no claim."

***

Minerva's Tinkerbell sheets are tucked into a hospital bed now. Since she stopped eating a few years ago, a feeding tube delivers nutrients into her abdomen. An oxygen device supplements her breathing. Twice a week, she receives visits from a nurse and a therapist. She uses a walker to hand out candy at Halloween.

"My dad knew that Minerva would never be put in a home or an institution," said Leon Jr. "There's a real person, a real human being in Minerva …"

His voice trailed off. The promises he made to his father are getting harder to keep. Since Nov. 19, 2010, he has been fighting the oil companies and his uncle in court. After multiple rounds of appeals and judgments - all in his favor - little has been resolved.

"This case was litigated for over four years," Lopez wrote. Each time ConocoPhillips lost, the judge noted, the company tried to start over by challenging jurisdiction, turning the lawsuit into a probate proceeding and deploying other baseless tactics.

On May 11, 2015, Lopez signed an order directing ConocoPhillips to pay Minerva $3.7 million, plus attorney's fees of $1.1 million. The order was titled, "Final Judgment." ConocoPhillips has appealed.

"Maybe I would've given up years ago, but I know Minerva needs somebody to stand and fight for her," Leon Jr. said. "And we want Conoco to do the right thing."

Now he is running out of time. The IRS has posted the family home for foreclosure sale on Oct. 29.